MyProNoblis

Als Privatanleger direkt renditenstark in den Mittelstand investieren.

Jetzt für den Newsletter registrieren

Aktuelle Informationen zum Corona-Virus

The MyProNoblis project will launch soon.

If you want to be part of the MyProNoblis project from the beginning, fill out the form and stay up to date.

MyProNoblis in detail

ProNoblis Asset Classes

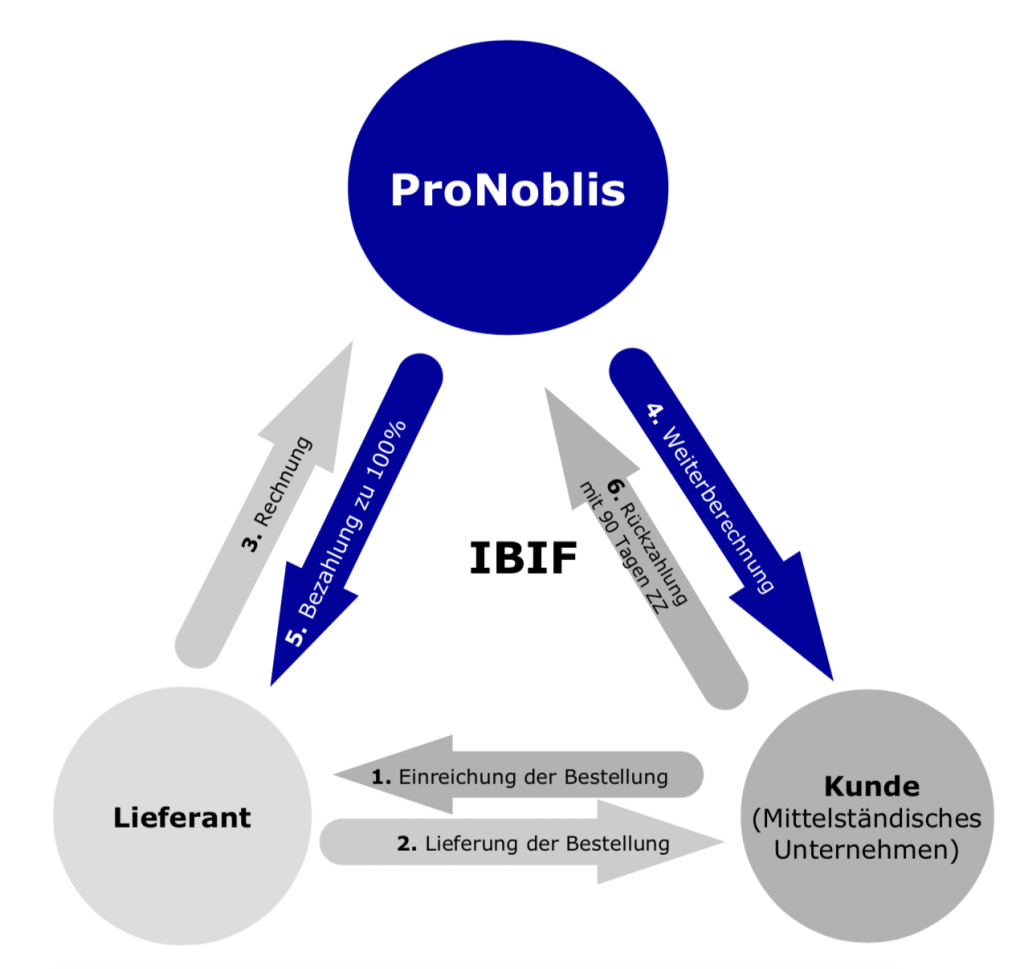

1st asset class Working Capital / IBIF: InBetweener-Invoice-Finance: Planned, calculated pre/interim financing of goods orders with up to 90 days payment period. Trade credit insurance serves as collateral.

2nd asset class subordinated loans ( investments > 1 year maturity): provision of subordinated loans to improve the equity ratio of companies – always linked to investments. In advance, ProNoblis carries out an internal review and risk classification of the companies and projects. We thereby give corporate customers the opportunity to advance growth projects independently from bank financing and/or in addition to existing bank loans. In turn, private investors have access to a lucrative asset class with a return of investment between 5.5 and 9.0%, depending on the risk gradation.

3. asset class loans: Private customers can invest in short and medium-term loans in loan projects analyzed by ProNoblis. Short maturities create manageable capital commitment and risks with interest rates of 2.9 - 6.0%. All our loans are secured by promissory notes. Since 1530, world trade has been built up secured by promissory notes. We bring the most intelligent hedging instrument back into use – modern, simple, fast.

IBIF - ProNoblis' solution for Working Capital

Our

Mission

Furthermore, due to the continuously low interest rates, the demand of private investors for innovative and lucrative investment products has risen enormously.

ProNoblis offers innovative financing instruments to SME as a supplement or/and alternative to working capital loans and overdraft facilities. With more working capital, companies can secure their liquidity flow and finance the purchase of goods and projects and in a structurated and targeted manner.

ProNoblis offers innovative financing instruments to SME as a supplement or/and alternative to working capital loans and overdraft facilities. With more working capital, companies can secure their liquidity flow and finance the purchase of goods and projects and in a structurated and targeted manner. We are thus closing the structural gap in the supply of credit for small and medium-sized enterprises, which has become wider since the financial crisis. We give SMEs access to highly attractive financing alternatives that are much faster and less complicated than factoring, supplier loans or bank loans. At the same time, investors can build up their own assets purposefully.

Collaterals

No financing without collaterals, this is the only way to protect investors. In contrast to traditional banks, other online credit providers usually do not require collaterals from their customers. Experience has shown that this is a very high risk that can not be controlled with modern technology on it's own. This is why we do not broker unsecured loans that are classified as safe or risky solely based on a credit risk assessment. We hedge our business – and thus the money of our investors and shareholders – in two ways against possible risks: For example, loans are only issued in the amount of the approved trade credit insurance limit per company and promissory notes when collaterizing loans.

"ProNoblis" is derived from the Latin language. Freely interpreted, it means as much as "We for us" – and thus describes the core of our philosophy. Because ProNoblis is help for self-help: from us, for us. Since 2003, we have been working successfully to bring both companies and investors together and to create alternatives to bank offers – we understand ourselves as a provider of financing solutions for SMEs (small and medium-sized enterprises) and as an wealth accumulation partner for private and institutional investors. We merge our competences within the ProNoblis AG since August 2018 as the predecessor company, which existed since 2013 was formally transformed into ProNoblis AG.

We provide SMEs with working capital and fresh capital (short- and medium loans and equity-replacing subordinated loans). At the same time, we offer private and institutional investors the opportunity to invest in 3 new asset classes created by ProNoblis (subordinated loans, loans and working capital) with attractive returns.

We benefit from decades of experience in the credit business for granting of subordinated loans, loans and working capital to medium-sized companies and from our broad network: we maintain trusting and long-term partnerships with asset managers, family office managers, financial planners, insurance brokers and financial brokers as well as providers of insurance and investment products.

Book an appointment

for an individual consultation

Call us

030 790 16 58 80

Contact us

We are looking forward to your message